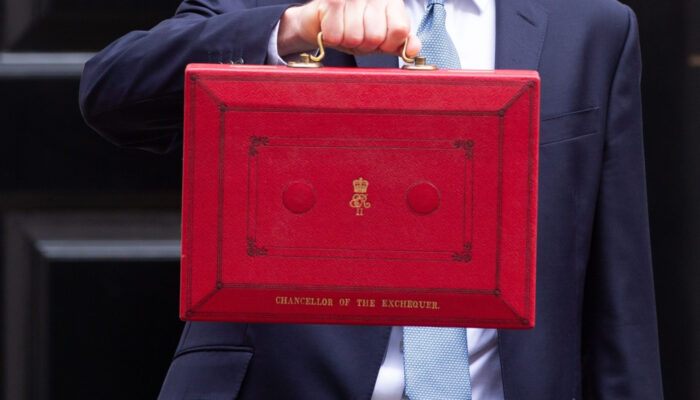

Spring Budget 2023: short-term pain for long-term gain

The impact for administrators

The Chancellor’s Spring budget brought about significant changes to the pensions system, including the removal of the lifetime allowance. This move is a welcome simplification for administrators who have long struggled to explain and navigate the complicated tax charge.

Removing the lifetime allowance has been a topic of political and industry debate for some time, with concerns that simplifying the system would inevitably benefit high earners. However, simplifying the pensions system does benefit all savers and especially administrators, regardless of political opinions. The removal of the lifetime allowance will reduce confusion and make it easier for people to save for their retirement, whatever their income level. While some may argue that more tax incentives are needed for low earners, removing the lifetime allowance is a step in the right direction towards a simpler, more accessible system for all.

The lifetime allowance has long been a source of frustration for pension savers and administrators. It limits the amount of money that an individual can save in a pension fund over their lifetime without facing additional tax charges. This limit has caused many people to unknowingly reach the ceiling and be hit with unexpected tax bills on retirement.

Communicating the lifetime allowance has also been a challenge for administrators, as they spend a lot of time explaining and checking it for members. With the removal of the lifetime allowance, communications will become simpler and more straightforward, making it easier for members to understand their retirement benefits. Setting up and paying benefits will also be more straightforward, with fewer forms and processes required.

However, implementing these changes will require significant effort, as most communications currently reference the lifetime allowance. It will take time for everyone to adjust to the new rules and for communications to reflect the changes. This also comes at a time when administrators are already stretched, supporting trustees with large-scale programmes such as GMP equalisation and Dashboard implementation. Nevertheless, the benefits of these changes are clear, and the pensions system will be simpler and more accessible as a result.

In conclusion, the removal of the lifetime allowance is a positive move towards simplifying the pensions system. While not everyone will benefit from the tax incentive it offers, the changes it will bring to communications and processes will benefit all savers. The implementation of these changes will require effort, but will result in a simpler pensions system that makes it easier for individuals to save for their retirement, regardless of their income level.