How much do members really understand?

Background

At the end of 2021, we ran our second annual Trust & Confidence Index, measuring trust and confidence among members in their own retirement savings and the pensions industry’s ability to support them.

In previous research, members’ confidence in their own decisions and savings ability was noticeably higher than their confidence in the industry. In the latest research we wanted to assess pensions knowledge by asking if members had heard of a number of key pensions terms, and whether they felt they could explain these terms to others.

Here we identify some of the key responses overall and disparities among the different age groups – 18-24, 25-34, 35-44, 45-54 and over 55’s.

Have you heard of these terms?

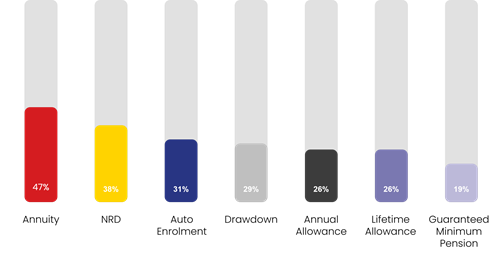

Of all the pensions terms, none of them had been heard of by more than half the audience. Annuity came top with 47% of people having heard of it, followed by NRD at 38% and Auto Enrolment at just 31%. The lack of people who have heard of Auto Enrolment is difficult to explain, given the media campaigns and compulsory communications that employers are required to issue to their employees.

One of the most shocking results was that over a third (34%) of respondents said they hadn’t heard of a single one of the seven pensions terms.

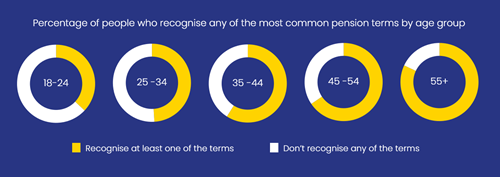

- There is a correlation between knowledge and age. With only one exception (Auto Enrolment), the percentage of people who said they had heard of the terminology increases as you move through the age groups.

- The over 55s were the only age category where more than 50% had heard of any of the terms. 71% said they had heard of our most well-known term, annuity, with NRD being the only other term that scored over 50%.

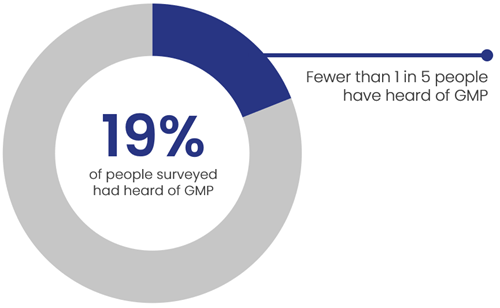

GMP is our least well-known term, with fewer than 1 in 6 having heard of GMP in every age category other than the over 55s.

- Knowledge of the term Auto Enrolment is consistent throughout the age groups with a peak in the 35 to 44 group. This could be because more people in this group are changing jobs and being enrolled into pension schemes at the stage of their life where they are planning more (e.g. marriage, children, family homes, savings, investments etc.)

- And when it comes to not having heard any of the terms, it’s up to the reader to decide which is more shocking: that 63% of 18–24-year-olds had not heard of any of them, or that 18% of over 55’s – who are eligible for early retirement and should be thinking about their plans – didn’t have knowledge of any either.

If you’ve heard of them, can you explain them?

- The better news is that more than half of those who had heard of each term felt confident that they could explain their meaning to friends and family. 79% for Auto Enrolment was the peak figure, with NRD at 76%. All others were fairly evenly split, with between 51% and 58% confidence in their ability to explain the terms.

- If you consider that everyone who hadn’t heard of a term before would also not able to explain its meaning to others, this only leaves only three terms that could be explained by around 1 in 4 people (NRD 29%, Auto Enrolment 25%, Annuity 24%). Only 10% felt confident they could explain GMP to another person.

- Whilst confidence levels increased in tandem with age groups, there were one or two interesting exceptions. More of the 35-44 age group felt they were able to explain GMP than any other age group, despite being unlikely to hold any of these benefits themselves.

- The oldest age group (over 55s) were the most confident that they could explain Auto Enrolment, despite this group being more likely than their younger counterparts to already be enrolled in a scheme and potentially less reliant on DC pension provision.

In summary

- Given the lack of understanding displayed across all age ranges, should the industry focus on the large majority of younger people with little understanding, or the smaller group closer to retirement who have a knowledge gap which may well impact their imminent retirement decisions?

- Given the shift towards DC benefits via auto enrolment and income drawdown, building understanding and confidence in these terms should certainly remain areas of focus for the longer-term.

- Given the extent of the problem, it’s unlikely that all issues of understanding can be solved overnight. This is where it’s important to be consistent, minimise jargon, and focus on making member communications as easy to understand as possible.

Joe Anderson is Business Development Manager at Trafalgar House