Does Great Britain have a trust deficit?

In today’s ever-fluctuating economic landscape, the question of trust in the pensions industry is increasingly relevant. To gain insights into the level of confidence that the public has in this sector, we conducted our annual Trust & Confidence research. This year, we surveyed 2,000 residents across Great Britain, asking them to rate their trust in the pensions industry on a scale of 0 to 10. The results present a telling snapshot of regional variations in trust and raise several questions that the industry needs to address.

The 2022 research produced an average trust score of 4.95 out of 10. This figure, falling below the midpoint of the scale, suggests that there is room for improvement when it comes to public confidence in the pensions sector. This lacklustre average opens up avenues for further investigation into the factors contributing to such a lukewarm response from the residents of Great Britain.

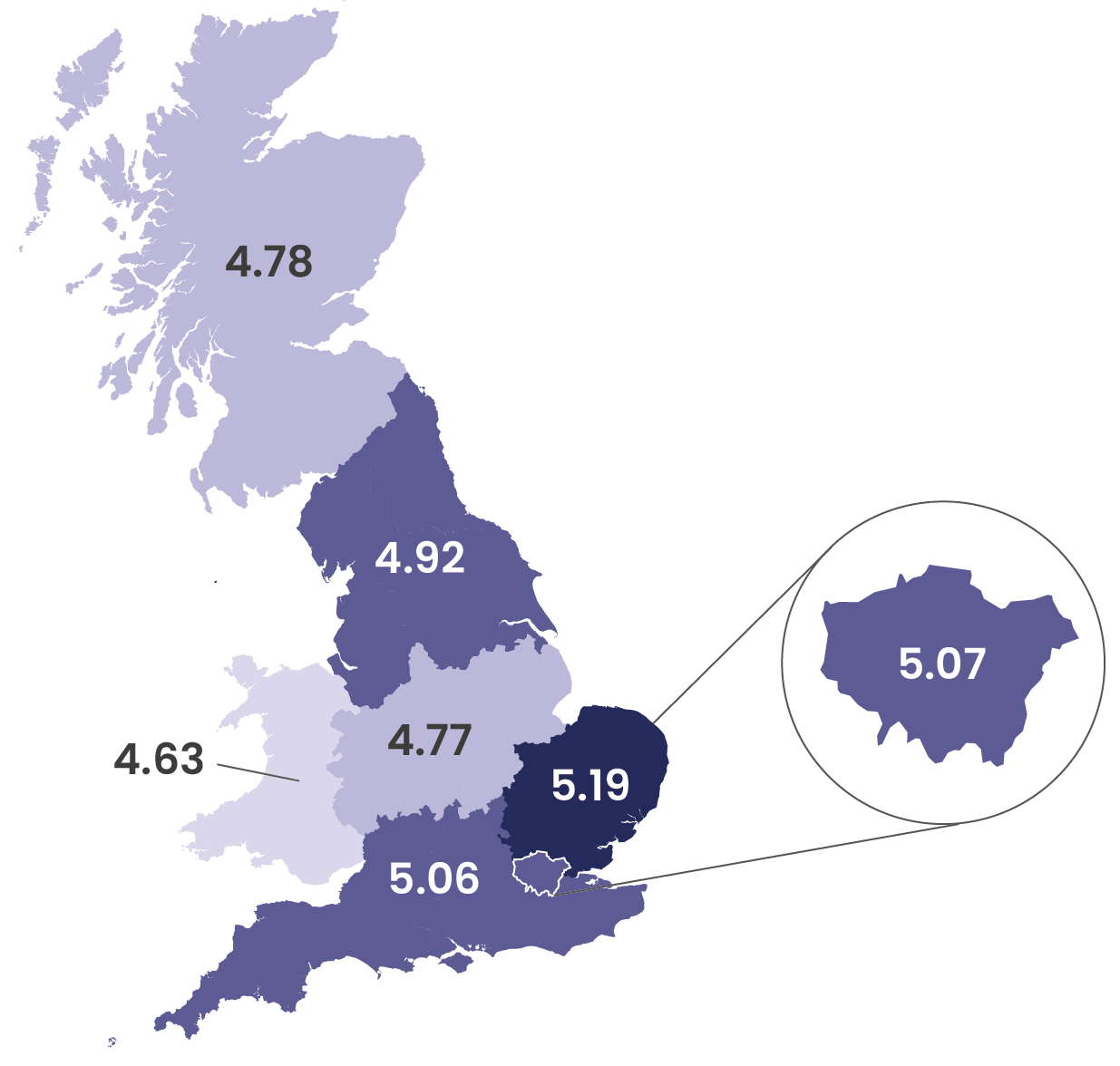

Geographical Disparities: From Wales to the East of England

The study revealed intriguing variations in trust across different regions, suggesting that geography plays a significant role in shaping perceptions. The lowest trust rating was 4.63, given by residents of Wales. One could speculate whether economic conditions or past experiences with pension providers in Wales contributed to this low score.

Conversely, the East of England topped the list with a trust rating of 5.19—a figure 12% higher than that of Wales. Residents here seem relatively more optimistic about their future in relation to pensions.

Does Great Britain have a trust deficit?

To break down the results further, here’s a regional overview of trust scores, listed from highest to lowest:

| Region | Trust Score |

|---|---|

| East | 5.19 |

| London | 5.07 |

| South | 5.06 |

| North | 4.92 |

| Scotland | 4.78 |

| Midlands | 4.77 |

| Wales | 4.63 |

Analysis and takeaways

- Urban vs Rural Divide: One notable observation is the higher trust score in London, a financial hub, compared to the more rural regions like Wales. It begs the question of whether accessibility to financial services and advice contributes to this disparity.

- Cultural Factors: Scotland’s score sits below the national average, prompting us to ponder whether historical or cultural factors influence public sentiment towards financial systems there.

- Economic Climate: It’s worth investigating whether regional economic conditions, such as employment rates or average salaries, correlate with these trust scores.

Conclusion

The Trust & Confidence research of 2022 serves as an eye-opener into the variances of public trust in the pensions industry across Great Britain. While the average score of 4.95 is hardly commendable, the regional disparities provide deeper insights into the complexities of public sentiment. Further research is needed to pinpoint the causes of these regional differences and address them effectively, with the aim of bolstering trust nationwide.

By acknowledging and dissecting these findings, the pensions industry can begin to formulate strategies to enhance public trust. With these metrics in hand, the onus is now on industry stakeholders to make concerted efforts to raise these scores in future years.