The pensions gender trust gap

The pensions gender trust gap

The well-documented gender pensions gap is one of the industry’s tougher problems to tackle – how to change the fortunes of a specific section of membership with uniquely different working and saving opportunities.

Encouraging later life saving is critical in helping many women with historic gaps in both their working life and retirement provision, and requires a united front from advisors, schemes and employers. But while this female savings void may have previously been seen more as a wider societal development that the pensions world had little control over, there are signs now that the industry is helping exacerbate the very problem it’s trying to fix.

The gender issue in pensions

Look back over previous generations and it’s clear that working practices and gender roles in society contributed to a significant disparity in the savings of women and men. A recent report found this gap to be as large as a 40.3% [1], less of a gap, more of a chasm in pension savings. The impact of childcare or other caring responsibilities has left gaps in the employment and national insurance histories of many women, but also affected the type of roles and the hours they work – and all this before we even consider the wider issues of gender pay and opportunity gaps in today’s society.

Whether specifically designed to address this issue or not, in the old final salary job-for-life world this cultural imbalance was often offset by the inclusion of spouse’s pension entitlements and generous retirement packages. But the world has moved on from DB without the message being made clear enough – to women in particular – that their pension provision would struggle to keep up as a result.

And while we in the industry might believe the situation is simple for these members – “join the scheme, increase your contributions and we’ll take care of your money until you retire” – we’ve made quite a big assumption that people trust the industry enough to hand over their money. Are we missing an important point that years without the capability, engagement or encouragement to adequately save for retirement have actually left some women lacking the trust and confidence to save?

Confidence in savings

When looking at the results of our recent Trust & Confidence research, it’s clear that a disconnect exists between some women and their retirement savings.

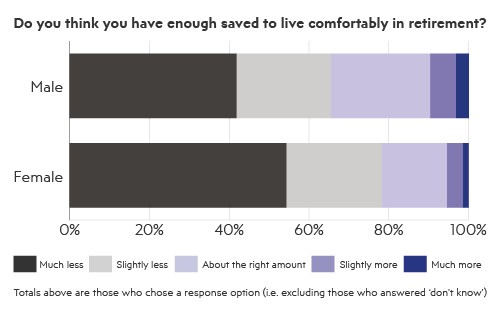

The gender difference was particularly stark when looking at how confident people are that they will have enough money to live comfortably in retirement, which is ultimately the purpose of the entire industry. 34.6% of men believed they would have the right amount or more than was needed, but only 22.8% of women felt the same – a huge disparity. The fact that the remaining 77.2% of women believed they have slightly or much less than they need shines a spotlight on the problem facing the industry.

Trust in the industry

Our research also revealed a Trust & Confidence Index score of 4.56 out of 10 for how much people trust the pensions industry. Among men, this Trust Score was 4.62, but only 4.50 for women, a fall of almost 3%.

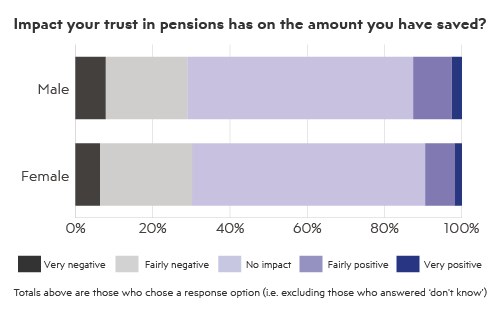

The issue goes further though, as three in 10 respondents (28.9% men, 30.1% women) said their trust in the industry had a negative impact on the amount they had saved, with only 11.2% (12.6% men, 9.5% women) saying it had positively encouraged them to save more. This is a shocking statistic that should make the industry stand up and take notice. We cannot win the battle to build retirement savings if members do not have faith in the pensions system to support them.

It’s evident from the wider scores that a lack of trust is a significant widespread concern that the industry needs to face up to, but the gender imbalance continued to show elsewhere too.

Members’ own decisions

When looking at the gender gap both in pension savings and trust in pensions, it’s important to factor in the difference in understanding and engagement reported by women and men when it came to their pensions provision.

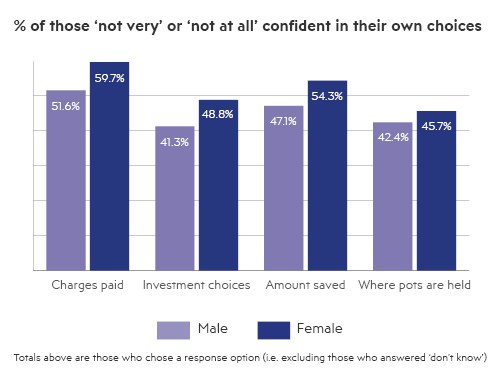

In every scenario tested by our research, women were less confident overall than men with the decisions they had made, with typically seven or eight per cent fewer saying they were very or fairly confident. These findings echo recent research indicating that men are more likely to plan and invest for retirement than women.[2]

The areas we assessed were; the adequacy of the amount they had saved, the investment decisions they had made and the fees they were paying, as well as where their money was held – showing confidence was lacking in all areas of saving. Building this assurance up through effective communication is key to restoring members’ faith in their own ability to save.

While it’s no surprise that many members are unable to answer each and every question about their savings – a lack of confidence was evident for both genders across the research – it still represents a large and ongoing hurdle for the industry to overcome.

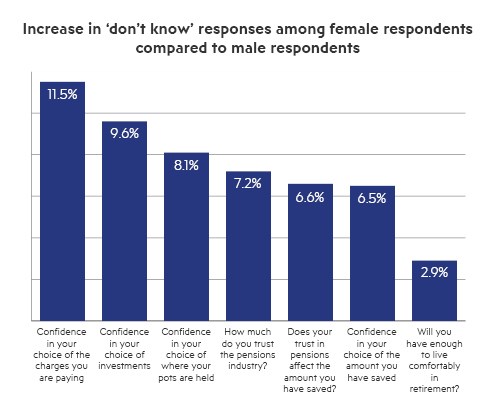

Across the key questions of trust in the industry, the impact of this lack of trust, the amount saved and confidence in their own decisions, on average women selected ‘don’t know’ 7.48% more than men. This was most stark on the questions of investments (11.5% difference) and fees & charges (9.6% difference).

This highlights the vital importance of giving members an outlet to aid their understanding, whether that’s an online portal they can test out themselves or face-to-face time with a pensions expert. A lack of confidence is understandable in the current economic climate, but a lack of understanding is a warning that needs greater thought and action.

In summary

While there are some definitive reasons why many women’s savings levels are below men’s, it’s evident that the closing of this gap is being held back by a notable lack of trust and confidence among women in the pensions industry and in pensions more widely. Overcoming this lack of trust must be a priority for the industry and further strengthens the calls for more tailored communications and a more personal service for different types of member need.

Clear and informative guidance on areas such as state pension top up payments for missed NI years, explaining the benefits of opting-in to schemes and the material benefits of increasing contributions would go a long way to improving the long-term outlook. We also need to think about the challenges facing women’s saving and to present the options and conversations they should consider having, such as asking their partner to pay into their pension if they’re higher earners.

Not many service industries would be content for their customers to not understand what they are getting and why they are paying towards it. There’s a knowledge gap to be filled if people don’t seem to know their own situation and requirements. Whether the long-awaited dashboard or some moves by schemes and employers to offer financial advice as part of the pensions package will be enough to raise this understanding, we will have to wait and see.

In the meantime, the whole industry – trustees, sponsors, regulators, advisers and administrators – should take a close look at what they are delivering to members and ask whether they can do more to help understanding and create trust.

Karla Bradstock is Technical Manager at Trafalgar House.

Download a full copy of the Trust & Confidence Index 2020.

- [1] https://prospect.org.uk/news/gender-pension-gap-increases-to-40-3-new-prospect-research-shows/

- [2] https://www.irwinmitchell.com/news-and-insights/newsandmedia/2021/february/men-more-likely-to-plan-and-invest-for-retirement-than-women-new-survey-shows